Thrax Oscillator Wave

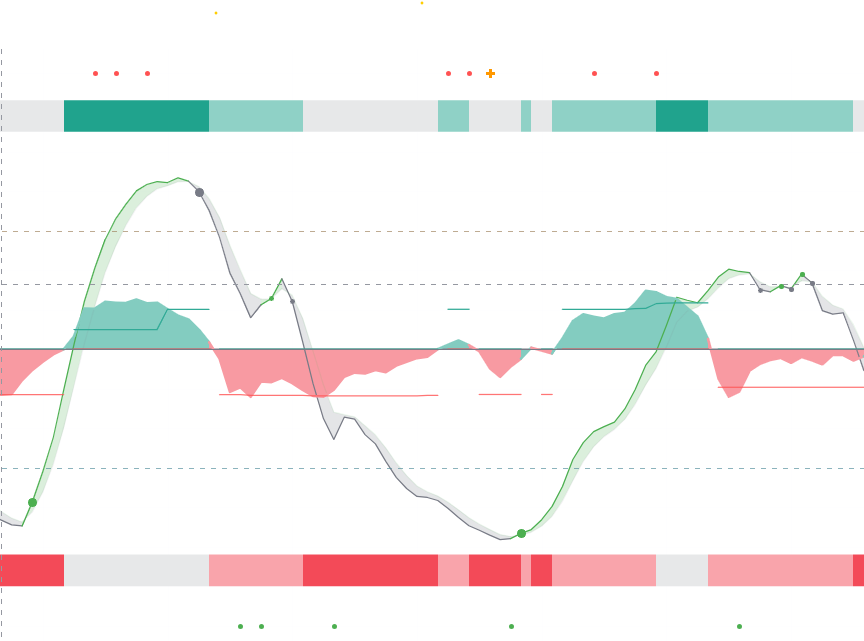

Thrax Oscillator Wave is a specialized oscillator developed using various tradional oscillator indicators helping traders in capturing accurate price movements and reducing noise.

Key Features

1. Singal wave

Description: Singal wave is the one that will give traders an indication of where the market is heading. Green area near signals indicates an upward market whilte grey indicates a neutral or a downward movement. Singal length and smoothing parameter can be controled by traders according to their use cases as shown below Purpose: Traders can use this feature to gauge market sentiment and anticipate potential trend reversals. Traders can also this as a confirmation indicator when using this with other indicators like price actions.

2. Trend Reversal points

Description: Signal wave displays four kinds of points as highlighted in the image below. There is a strong bullish reversal, strong bearish reversal, weak bullish reversal abd weak bearish reversal. Purpose: Traders can use these reversal points to capture the market reversal. Strong reversals can be used to be more sure of reversal while weak reversal can be used by a riskier trader to capture the trend reversal much earlier bearing the risk that reversal might not actually happen

Incorporating Thrax Oscillator Wave into your trading strategy can provide you with valuable insights into market sentiment and trend reversals, helping you make more informed trading decisions.

2. Trend divergences

Description: Thrax scans and displays divergences between price movement and thrax wave on chart. Like many other divergences, divergence between thrax wave and price provides traders potential opportunities to initiate trades Purpose: Traders can use divergence to initiate a long trade if the thrax wave is going up but price is going down. Similarly, short trades can be initiated if price is going up and thrax wave is going down